This is an article I published several years ago and I’ve reviewed and updated it to ensure it’s current.

A few days ago I did a search on “couch potato portfolio” on Google. I saw a few really good blogs on the topic. I went to one of them where the website was completely devoted to the topic and it had so much information. It had lots of good content. The focus was on ETFs and couch potato investing.

If I remember correctly, the term came about from the Toronto Star when they wanted to profile investment portfolios from several experts in the industry specifically several different mutual fund managers vs a professor in finance vs dart board.

It was basically those in practice vs theory vs randomness.

The randomness was the Toronto Star throwing darts against a wall with a list of TSE 300. They picked their stocks based on the dart throwing. According to the Star, they had a difficult time getting any mutual fund manager to participate.

When you’re looking for investment advice, think about it, mutual fund managers would be afraid to go up against randomness. They’ve got everything to lose.

Let me say upfront, I’ve had all the educational requirements to become a portfolio manager or investment manager, at least back in 2008. And I can understand why they wouldn’t want to participate. Think about it, you’ve done all this studying and received these credentials, and then you happen to lose against randomness. And there’s pretty good change of losing! Whereas “randomness” is just a concept / process that has got nothing to lose.

In the end, they were able to find some mutual fund managers who made their picks.

The professor of finance (Eric Kirzner) created his couch potato portfolio consisting of 60% stocks, 35% bonds, and 5% cash. The stocks was actually the TSX/60 ETF and the bonds was the Canadian Universe Bond Index ETF. The Toronto Star picked their stocks by throwing darts.

What happened next was a nightmare for the fund managers, and the professor in the short term. The darts went up by huge amounts in the first 2 years and the mutual fund managers and professor’s portfolio’s did not do great. Some picks may have even gone down, but, I don’t recall.

The professor did note upfront though that in the short term, you just can’t predict accurately what can happen with the stock market. After a number of years, if I recall correctly, the professor’s simple portfolio came out on top. And this was no surprise as over the long term, few people beat the market.

Since then, ETFs has become mainstream news. There are so many ETFs coming out, my guess is that they will become like the next mutual fund industry. It will boom like crazy that there will be more ETFs than there are stocks to choose from, the way mutual funds did at least a decade ago, if not long before that.

This is great and it’s not so great. What was originally a simple portfolio has turned into an industry topic. There is so much information on it now, it’s not appearing simple anymore, especially when I see the multitude of different versions of couch potato portfolios.

When I first wrote this article on another website I owned, I thought I was going to have a website like some of the blogs I saw in my search results for couch potato portfolio. But, then I realized, what’s really to talk about? And how much can you write about something so simple?

- It’s 3 investments

- Re-balance once a year

That’s it! To any of you reading this, remember these two points! Don’t get overloaded with all the financial information out there which I once read was called financial pornography! If you start trying this country index with that specialty index, and switching between commodity and / or country and then adding inverse ETFs, a hedge fund ETF, maybe a style index ETF, you’re doing no different than trying “stock picking” or mutual fund picking. STOP right now, understand the concept of couch potato in the name, “couch potato portfolio” and go back to the original concept:

- It’s 3 investments

- Re-balance once a year

MoneySense came out with their own version of the portfolio and it’s just as simple as the professor’s except that it consists of equal portions of 3 ETFs. And how has this (MoneySense) portfolio fared over the years? According to their magazine, between 1976 and 2014, it had an average annual return of just over 10%!

In response, many financial planners and Investment Advisors will tell you, “Past performance is not a guarantee of future returns.” They are required by law in written material, at least for the Investment Advisors.

But, tell me this, you need to hire between 2 people: Person 1 has a track record of excelling in 5 different jobs he/she has had in the past 10 years. Person 2 in the past 10 years can’t tell you anything he/she has accomplished in the 5 jobs he/she has had. Who are you going to hire assuming both tell you that they can do the job?

And what are these 3 investments. First, let me say in caps, I CANNOT ENDORSE OR RECOMMEND THESE INVESTMENTS. ONLY A LICENSED INVESTMENT ADVISOR FOR YOUR PROVINCE CAN. This is another legal requirement by the Ontario Securities Commission. The three investments are:

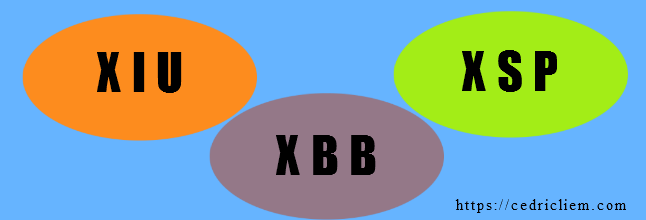

XIU – Canadian TSX/60 ETF

XSP – S&P500 ETF – Canadian Hedged

XBB – Canadian Universe Bond Index ETF

I know, some are thinking, just because someone excelled for years, doesn’t mean it will happen forever.

I realize that. I’ve had conversations where people bring up the “student excelled in high school and flopped in university” line. Heard it.

And if you want to go with that logic, by all means. Go ahead and buy that stock with no history or earnings and is supposed to make a million bucks real soon.

It’s your money, not mine. I can’t recommend stocks anyways!